Hamas Ltd: The financial muscle of the Palestinian Islamist militia

The U.S. is pressuring countries like Turkey to cut off the funds that feed the organization, which until it took power in Gaza was fueled by money from Iran and private donations

On Friday, a few hours before U.S. Secretary of State Antony Blinken landed in Istanbul for difficult talks with the Turkish authorities over the two countries’ conflicting positions on the Gaza war, his office announced a reward of up to $10 million for information on five members of the financial structure of Hamas, designated as a terrorist organization by Washington. Three of them, it is believed, are based in Turkey. Israel’s leaders and their U.S. allies are convinced that, in order to wipe out the Palestinian Islamist militia, they must also target its sources of financing and a structure that includes companies and million-dollar investments in various countries, including a once reliable ally like Turkey, which over the last decade has hosted leaders of a group Istanbul considers a “liberation movement.”

Terrorist group or resistance movement, Hamas’ armed struggle costs money: to buy weapons, maintain military infrastructures (drone and rocket factories, tunnels, bunkers and barracks), pay its fighters, and compensate the families of those who die. And Gaza — the group’s operational base — is not exactly an economic paradise: the Israeli blockade has left half of the residents of the enclave unemployed and its population with a per capita income of barely $1,150. So where does the economic infrastructure to support Hamas come from?

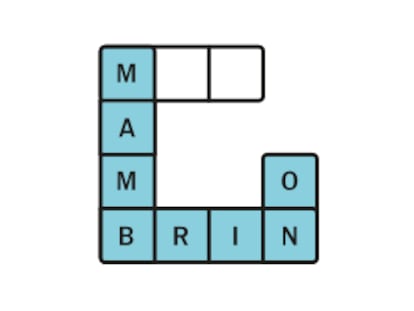

“Until Hamas took control of the government in the Gaza Strip, it was financed mainly by Iran and the abuse of charities,” Matthew Levitt, director of the Washington Institute’s Counterterrorism Program and a former U.S. Treasury and FBI employee, tells EL PAÍS: “But in the last 10 to 15 years, its main source of income has been the control of territory in Gaza.” Hamas’ operational and military budget is estimated at about $600 million per year, which is on a par with the military spending of states with similar populations to Gaza, such as Slovenia, Latvia and Armenia, or around $250 per capita (Israel’s military expenditure per capita is 10 times higher).

The Hamas government in Gaza imposes taxes on the import of goods through border crossings and, when these are not open, through the tunnels via which the enclave is supplied from Egypt. Together with taxes on commercial activities, this amounts to some $490 million annually. At the same time, Gaza receives around $2 billion annually from the Palestinian National Authority (PNA) in the West Bank and from international cooperation, including the United Nations, the European Union and Qatar. The latter delivers $360 million annually — until a few years ago, in briefcases containing cash — to pay the wages of civil servants and as aid to the neediest families, according to an agreement with Benjamin Netanyahu’s government.

Experts like Levitt believe that not all of the money budgeted for Gaza goes to the population, but that part of it is mixed with Hamas operational expenses, for example, the payment of fighters who are formally employed as civil servants: after the October 7 attack, the Israeli authorities revealed the identities of some militiamen who allegedly worked as policemen and civil servants in the Gazan administration. This source of income is considered to have ended with the virtual destruction and re-occupation of Gaza.

Iran remains a clear and notorious contributor, particularly to Hamas’ armed wing, the Izz ad-Din al-Qassam Brigades. The organization’s own political leader, Ismail Haniyeh, acknowledged in an interview with Al Jazeera in 2022 that Iran had contributed $70 million to bolster its defense. Expert estimates vary between that figure and $120 million annually. In addition, Hamas continues to receive donations from the Palestinian diaspora and individuals in various parts of the world in crowdfunding campaigns that it advertises through social networks. Funds are sent to Gaza through the hawala method or cryptocurrencies, although the latter has been found to be less secure as it can be tracked through blockchain technology. U.S. and Israeli intelligence have reported that important nodes for these transfers — currency and cryptocurrency exchanges — used by Hamas are located in Turkey.

Hamas’ business empire

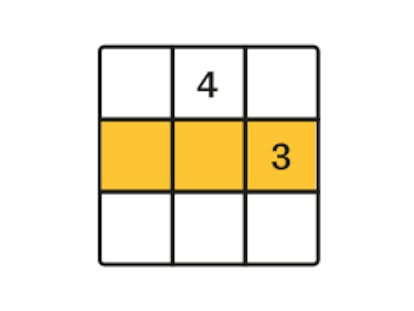

But to avoid this donor dependence — for example, contributions from Tehran were significantly reduced when Hamas aligned itself with the Syrian opposition against the Iranian-allied regime at the beginning of the last decade — Hamas established a finance committee, whose leaders have for more than three decades resided abroad (first in Jordan, then in Saudi Arabia and later in Turkey), and an investment office under the Shura Council. According to U.S. intelligence, Zaher Jabarin has been the head of Hamas’ financial arm since 2017 and is believed to reside in Turkey; the investment office has been headed variously by Ahmed Odeh, Usama Ali and Hisham Qafisheh, all of whom have resided in or spent time in Turkey. Qafisheh, who has held senior positions in several Hamas-run companies, obtained Turkish nationality in 2021 and changed his name to Hasmet Aslan, according to data from the commercial registry consulted by EL PAÍS.

The U.S. Treasury estimates that Hamas’ assets abroad amount to $500 million and include companies such as the Al Zawaya Group, which maintains subsidiaries in Cyprus, Turkey, Spain (a real estate company in Valencia) and Sudan, and which received juicy contracts in roads, mining, and the agricultural sector until the fall of the Islamist dictator Omar al-Bashir. Washington has also sanctioned other construction and real estate development companies that it considers part of the militia’s financial web in recent months, such as Algeria’s Sidar, Saudi Arabia’s Anda and the Emirati Itqan Real Estate JSC, which Hamas tried to sell in 2019 for $150 million.

“The United States has a long tradition of sanctioning innocent people without concrete evidence,” says Ali Bakir, an expert on Turkey and professor at Qatar University, for whom these accusations are part of a campaign aimed at countering allegations of “genocide” against Israel. “Some circles in Washington are trying to extort money from countries that defend the Palestinians, such as Turkey,” he adds.

The company that has stirred up the most dust after being singled out by Washington is Turkey’s Trend GYO, a publicly traded firm that recently completed the construction of the new building at the Istanbul Commerce University, an institution linked to the Istanbul Chamber of Commerce. The company was founded in 2006 by Qafisheh and Saudi national Saleh Mangoush, under the name Anda Gayrimenkul, which later changed to Trend GYO in 2017. As early as May 2022, the U.S. Treasury placed it on its sanctions list by identifying it as one of the “key components of Hamas’ global asset group.” Since then, various managers and shareholders have been subject to three other rounds of sanctions.

“It’s really not hard for Hamas to do these things,” Levitt explains. “All they need is people who don’t go around in Hamas uniform and who are willing to run a company and, when it hands out dividends, divert some or all of them to Hamas.” On paper, everything works as it should — in fact it is subject to independent audits and the scrutiny of the Turkish Securities and Exchange Commission. So much so that, according to an investigation by The New York Times, international clients have purchased Trend GYO shares through U.S. and European banks, including the Church of Jesus Christ of Latter-day Saints, an irony of global capitalism.

The Turkish Ministry of Finance said last month that it had reviewed the accounts of Trend GYO and related individuals and concluded that “they have not abused the Turkish financial system” and that it was in no way linked to the October 7 attacks on Israel. Speaking to EL PAÍS, a company source dismissed the U.S. Treasury’s allegations as “lies”: “We have no idea why they are attacking us; perhaps because our initial investors were Palestinians, but they have long since left [the company] and left Turkey. The current management doesn’t even know them personally.”

The past three years have seen a steady turnover of the board and shareholders, with most of the Arab investors leaving, according to the company registry. They were replaced by several officials linked to the AKP, the party of Turkish President Recep Tayyip Erdogan, and, despite the sanctions, the construction company’s shares have gained in value.

Amer Alshawa, one of the alleged Hamas financiers for whom the U.S. is offering the $10 million reward and who in 2015 was arrested in the United Arab Emirates on suspicion of aiding the Palestinian organization, served as CEO of Trend GYO between 2007 and 2019. In an interview with The New York Times, he denied having personal dealings with Hamas, but claimed to harbor suspicions that board members collaborated with the group: “Do I have proof? No. But sometimes you just have a feeling,” he said. “I really didn’t care. Why should I? I was there to make money.”

The dividends that the international investment conglomerate brings to Hamas are estimated at between $10 million and $20 million a year. “These investments are not liquid. They are not cash that you can access immediately,” Levitt points out. Their importance lies more in the fact that they are a fund to fall back on in times of need. For example, accounting documents obtained by Israeli espionage established that, after the 2014 war, Hamas sold $75 million worth of assets to rebuild part of its infrastructure in Gaza.

Now, after the destruction of Gaza, the seed of the Islamist group’s reconstitution could start there as well. “These investments generate ongoing revenues, and unless they are identified and frozen, they will continue to do so. But given the countries where they are located, it is unlikely that they will be frozen,” says Jessica Davis, a financial intelligence expert and former employee of Canada’s secret services: “If the group loses control of Gaza, almost all of its assets could be used for military or terrorist activities.”

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition